We brought Brooks’ Bra Finder into the real world to see if we could give runners a confident, self-guided shopping experience right from the bra hanger.

History and Context:

Brooks developed the Bra Finder Quiz as a digital tool to help runners find the right sports bra based on fit, support, and activity preferences. It performed well online so we wondered if this same tool could support in-store shoppers, who often browse solo, want to shop quickly, and are hesitant to ask for help when shopping for something as personal as a sports bra.

So, we took the quiz offline.

We leveraged a few testing methods including a discovery survey, in-person shop along, and an extended field trial to understand how real runners interact with the Bra Finder in a brick-and-mortar setting. We wanted to know: Would they use it? Would it help them? And would it lead to increased confidence in their bra choice?

Problem Statement

In-store sports bra shopping can be awkward and inefficient. Customers want autonomy but are often unsure where to start. Product walls are overwhelming, signage is inconsistent, and personal help isn’t always available or wanted. This creates a disconnect between the customer’s needs and their ability to confidently choose a bra that fits and performs.

We saw an opportunity to bridge that gap with the Bra Finder Quiz, a tool originally built for Brooks’ eCommerce website, by making it accessible via QR code in a physical retail store.

Objectives

We designed the study to answer three key questions:

Engagement: Would runners notice and use the QR code in-store?

Influence: Would the quiz influence what they tried on or purchased?

Trust: Would the quiz results feel credible and aligned with their needs?

We also wanted to identify where and how the QR codes should be placed for maximum visibility and impact.

Team and Role

As the Design Researcher, I led the study design, synthesized findings across phases, and translated insights into recommendations. Throughout these steps I worked closely with my UX Manager. We took turns interviewing participants and taking notes. Together we presented the data and insights to our digital product partners, and the go-to-market leads to inform strategies to bring digital tools into the physical retail environment.

Part 1: Pre-Discovery Survey. We launched a survey to 20 runners and explored how they shop for bras or shoes in retail stores, using open-ended questions in unmoderated sessions via UserTesting.com. The study aimed to uncover runners’ motivations, expectations, pain points, and future hopes around in-store shopping to inform digital Finder tools value in retail environments.

Key findings:

Shoppers value autonomy. They prefer to self-serve, avoid sales associate interaction, and rely on signage and layout for guidance.

“I want to be able to self-service in store… I don’t want to feel rushed or pressured.”Product availability is critical. When preferred sizes or styles aren’t in stock, frustration is high and often results in walkouts.

“If I go into a store, it’s because I need something now. If it’s not there, it’s a wasted trip.Both familiarity and variety drive confidence. Customers seek both variety and trusted styles they already know work for them.

“I’m inclined to seek out styles similar to things I know already work.”Touching the product builds trust. Feeling the material helps shoppers assess quality and support, even without trying on.

“I can tell by touching it if it’s good quality.”Efficiency in store is a priority. Many shoppers want a quick, focused experience—delays reduce satisfaction and purchase likelihood.

“I want to get in and get out with what I came for as fast as possible.”Agency and body confidence matter. Shoppers want to feel seen, comfortable, and in control—pressure or poor fit erodes trust.

“I don’t want to feel fat while shopping for sports bras.”

Part 2: Shop Along Qualitative Interviews in Store. We outfitted the Brooks Trailhead store with QR codes linking to the Bra Finder quiz. Then we invited 6 runners into the store and observed them shopping. We tested two QR code placements: on the bra hanger and on a table sign. We wanted to see if runners would scan the code and how the quiz influenced their decision-making.

Key findings:

Runners preferred QR codes placed on the bra hanger because it felt natural, relevant, and easy to find.

Most said they wouldn’t seek out a quiz, but when they took it, they were surprised by how helpful it was.

They were delighted when the quiz validated their instincts and curious when it recommended something unexpected.

Even skeptics said it made them more likely to try on a broader range of bras.

“The quiz did change my mind about what to try on. I think I'd try on more of these styles than I initially thought… the quiz added one more for me to try on.” - Stephanie, Participant 6Runners wanted to shop independently. They rarely asked for help and preferred to use the quiz on their own phones.

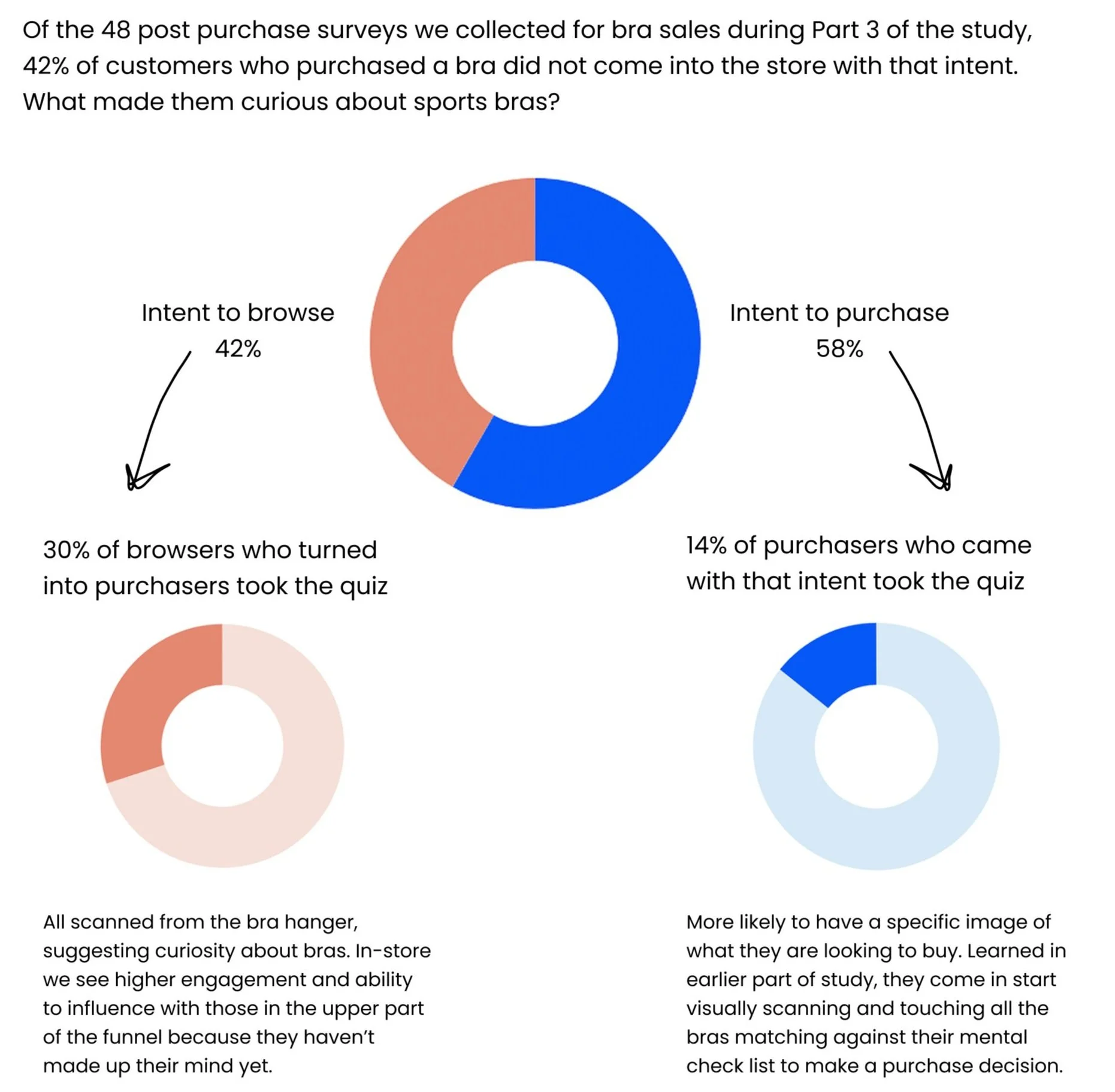

Part 3: 8-Week Live Test. We ran a follow-up field study with QR codes placed across 6 locations in the same store, tracking 122 total scans over 8 weeks. We gathered survey data from bra purchasers and mapped quiz engagement to sales behavior.

Key results:

The bra hanger was the highest-performing placement. It generated 34% of total scans, with 73% quiz completion.

21% of all bra purchasers took the quiz, and of those, 80% purchased a bra recommended by it.

Shoppers who were just browsing were more likely to use the quiz than those who came in with a specific purchase intent.

After investing time in-store, customers felt more urgency to leave with something even if it wasn’t a perfect match.

When quiz results didn’t reflect the customer’s input (e.g., recommending underwire bras after they selected "no underwire"), it eroded trust in both the quiz and the brand.

Solution Recommendations

Strategic Placement

QR codes must be as close to the product as possible especially in busy, multi-product (and multi-brand) environments.

Address Quiz Usability and Clarity

Update question language to match how runners talk about bra feel (e.g., “secure,” “supportive” vs. “holds me in”).

Reduce visual friction on mobile (e.g., animations and newsletter sign-ups blocking CTAs).

Better Match Transparency

Clarify how quiz inputs connect to results so runners understand why each bra was recommended.

The results page has a lot of information that attempts to connect these dots but is instead providing noise

Personalization = Trust

Runners wanted to rank their personal priorities (e.g., neckline, support type) and adjust results accordingly.

Runners believe they are the expert on their bodies, and we should follow their lead. Bra features are highly subjective.

In-Store Inventory Importance

In a physical retail setting, it’s critical to indicate which bras are actually available in the store—otherwise we risk frustration or lost sales to competitors.

Another consideration here is connecting to endless aisle, and ensuring that customers can buy the product they want seamlessly if it isn’t available in store.

Outcomes

This study helped us prove that, with some key updates, the Bra Finder could successfully extend into the retail environment. Runners used it, found value in it, and bought bras they might not have considered otherwise. We now had real-world behavioral data to support partnerships with multi-brand retailers and informed UX changes that shaped future iterations of the Bra Finder itself.

Perhaps most importantly, we learned when and how this tool is most useful: before a shopper starts evaluating options on their own. Timing and trust are everything.